Tax Breaks and Battery Backups: The Ultimate Guide to Getting Paid to Protect Your Home in 2025

Share

Here's something most homeowners don't realize: the government is literally paying you to install battery backup systems in your home right now. But here's the catch, you've only got 22 days left to cash in on some of the most generous incentives we've seen in years.

As someone who's been in the power protection business for years, I can tell you that 2025 is hands down the best year to invest in home battery backup. Between federal tax credits, state rebates, and utility incentives, you could be looking at thousands of dollars in savings. The problem? Most people have no idea these programs exist, and the biggest one expires on December 31st.

Let me break down exactly how you can get paid to protect your home with battery backup systems.

The Federal Tax Credit: Your Biggest Win

The federal government's 25D Residential Clean Energy Credit is the heavy hitter here. This isn't some small rebate, we're talking about 30% of your entire battery system cost with no cap on the dollar amount.

Think about that for a second. If you're installing a $15,000 battery backup system, you're getting $4,500 back from Uncle Sam. That's real money that goes directly toward reducing what you owe on your taxes.

What Actually Qualifies

Not every battery system qualifies, so let's get specific about what the IRS wants to see:

- Minimum capacity of 3 kilowatt-hours (kWh) - This rules out those tiny backup batteries you see advertised everywhere

- Brand new equipment - No used or refurbished systems

- Installed at your primary or secondary residence in the United States

- All associated costs included - The battery itself, installation labor, electrical work, permits, and any equipment needed to connect it to your home

The beauty of this credit is that it works whether you're adding a battery to an existing solar system or installing a standalone backup system. Many of our customers at Ace Real Time Solutions are surprised to learn that you don't need solar panels to qualify for this credit.

The Ticking Clock

Here's where urgency comes in: this 30% credit disappears forever on December 31, 2025. That's not "reduced to 20%" or "phased out gradually", it's gone completely for homeowner-owned systems.

To qualify, your battery system must be installed and operational by the deadline. If you order equipment now but don't get it installed until January, you miss out entirely.

State and Local Incentives: Stacking Your Savings

The federal credit is just the beginning. Many states offer their own incentives that you can stack on top of the federal money.

California's Goldmine of Programs

California homeowners hit the jackpot with multiple programs running simultaneously:

Self-Generation Incentive Program (SGIP) offers $150-250 per kWh depending on your system size. For a typical 10kWh home battery, that's an additional $1,500-2,500 on top of the federal credit.

California's 2025 Equity Initiative launched in June and provides up to $1,100 per kWh for qualifying households. Combined with other incentives, some homeowners are getting battery systems installed for practically nothing out of pocket.

Zero-Interest HEAT Loans let eligible homeowners borrow up to $25,000 at 0% interest specifically for battery installations. Even if you can afford to pay cash, why not use free money and invest yours elsewhere?

Massachusetts and Beyond

Massachusetts offers a different but equally valuable approach through Mass Save programs. You're looking at sales tax exemptions, property tax exemptions, and state income tax credits up to 15% of system costs (capped at $1,000).

Other states offer various combinations of rebates, tax credits, and financing programs. The key is checking with your state energy office and local utility company to see what's available in your area.

Who Can Actually Claim These Credits

This might surprise you: renters can claim the federal credit too, as long as they install the battery system in their primary residence and can document the expenses. Obviously, you'll need your landlord's permission, but the tax benefit belongs to whoever pays for the installation.

Homeowners can claim the credit multiple times if they install systems in different years or at different properties. There's no lifetime limit.

The one group that can't benefit? Landlords installing batteries in rental properties they don't live in. The IRS is clear that this credit is for residential use only.

How to Actually Claim Your Money

The process is surprisingly straightforward, but you need to do it right:

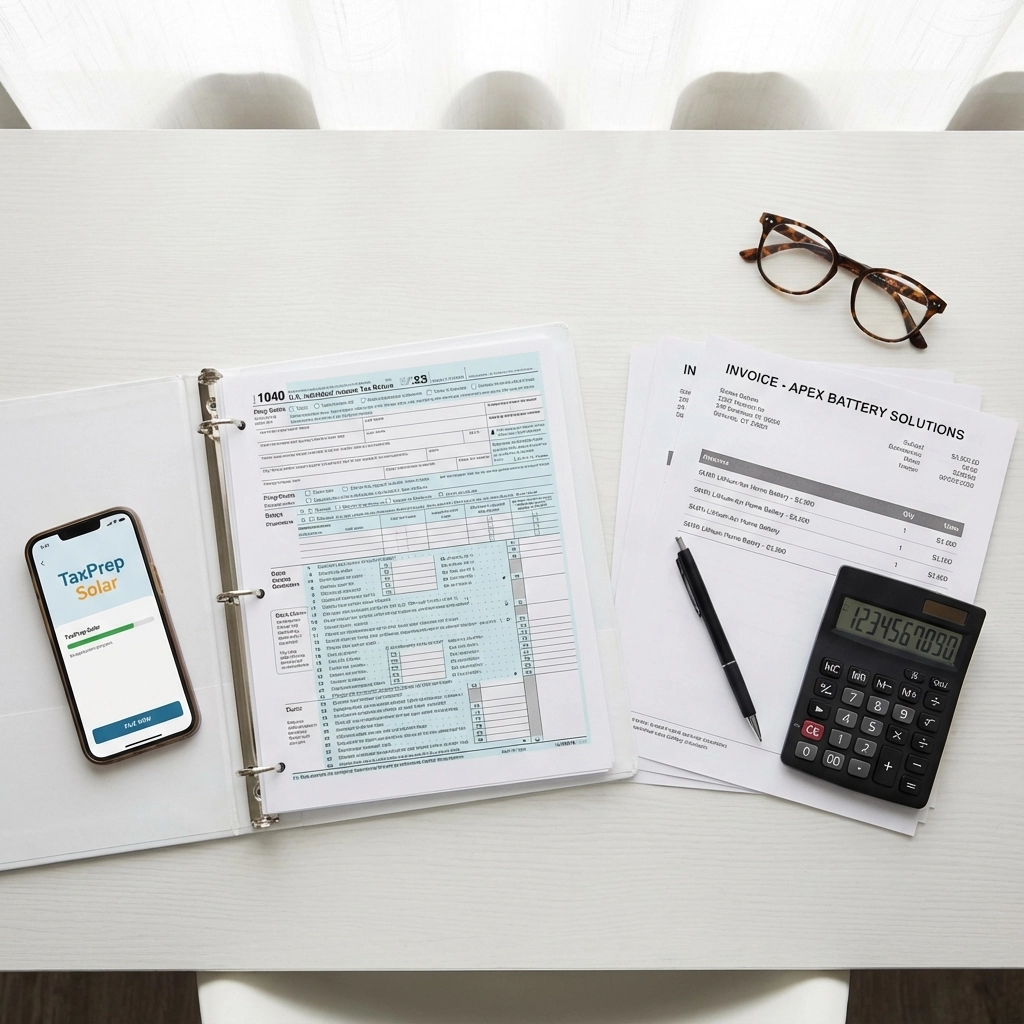

Step 1: Document Everything Save every receipt, invoice, and piece of paperwork related to your battery installation. This includes the equipment cost, installation labor, electrical work, permits, and any required upgrades to your electrical panel.

Step 2: File IRS Form 5695 This form calculates your residential energy credits and gets filed with your annual tax return. It's not complicated, but if you're not comfortable with tax forms, any decent tax preparer can handle it.

Step 3: Carry Forward if Needed This is a non-refundable credit, meaning it can only reduce taxes you owe, it won't generate a refund if you don't owe anything. But unused portions carry forward to future tax years, so you don't lose the benefit.

Maximizing Your Investment Strategy

Here's how to squeeze every dollar out of available incentives:

Size Your System Right: Make sure you hit that 3kWh minimum for the federal credit, but don't go bigger than you need just to maximize incentives. Focus on your actual backup power needs first.

Time It Strategically: If you're planning other home improvements that qualify for tax credits (like solar panels or heat pumps), consider bundling projects to maximize your tax benefits.

Choose Quality Equipment: Since you're getting 30% back, this is the perfect time to invest in premium battery systems from manufacturers like Bluetti or other top-tier brands. The tax credit makes high-quality equipment much more affordable.

Work with Experienced Installers: Proper installation documentation is crucial for claiming credits. Work with contractors who understand the requirements and can provide the detailed paperwork the IRS expects.

Real-World Example: What This Looks Like

Let's say you're installing a 10kWh battery backup system that costs $12,000 total (equipment + installation). Here's your potential savings:

- Federal tax credit (30%): $3,600

- State incentives (varies): $1,500-3,000

- Total savings: $5,100-6,600

Your actual out-of-pocket cost drops to $5,400-6,900 for a system that would have cost $12,000 without incentives. That's a massive reduction that makes battery backup affordable for most homeowners.

The Bottom Line

With 22 days left until the federal credit expires, this is genuinely your last chance to get the government to pay for 30% of your home battery backup system. Combined with state and local incentives, you're looking at savings that may never be available again.

The power protection industry is evolving rapidly, and battery backup is becoming essential infrastructure for modern homes. Between extreme weather events, aging electrical grids, and our increasing dependence on technology, having backup power isn't a luxury anymore: it's a necessity.

The fact that the government is willing to subsidize nearly half the cost of these systems tells you everything you need to know about how important they consider this technology.

If you've been thinking about battery backup, stop thinking and start acting. Contact a qualified installer this week, get your system sized properly, and take advantage of these incentives while they're still available.

Your future self (and your tax bill) will thank you.